FAQs

How can I find out if a check has cleared, what my current balance is, or the amount of my direct deposit?

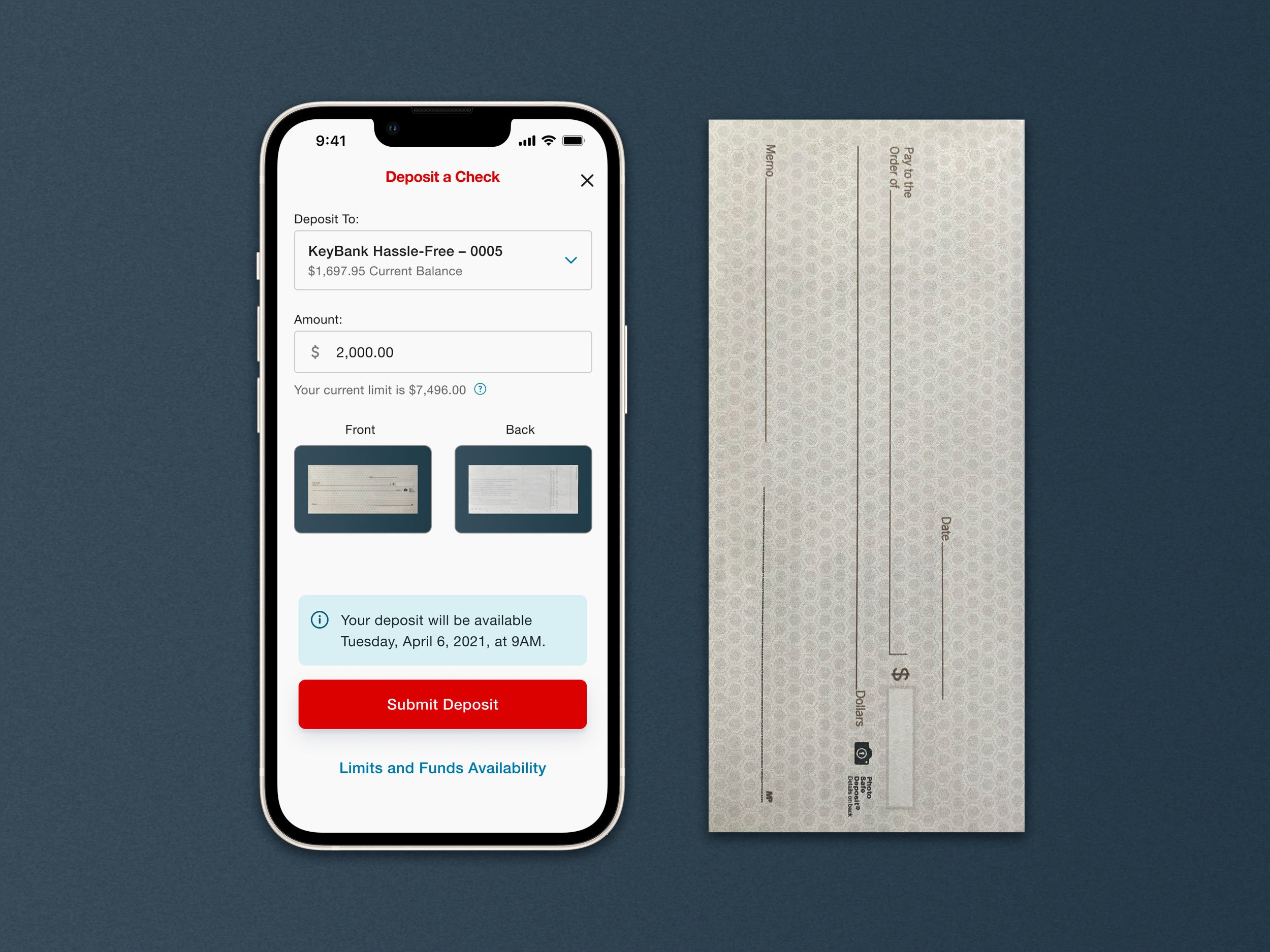

For a personal account you can access all of these items using our personal online banking system, iConnect, or by using the Mobile Banking Application, web browser, or text service via your cell phone.

For business accounts you can access of these items using our business online banking system, bizConnect.

If you do not have access to the internet, you are always welcome to stop in to any of our offices or call us. We will be happy to assist you with your inquiry.

How can I transfer between two accounts?

There are several methods to transfer between accounts.

- You can visit the location nearest you.

- You can call one of our offices to receive transfer assistance.

- The other methods include use of our electronic service applications – online banking or Mobile Banking.

How do I place a stop payment on an item?

You can receive help placing a stop payment by visiting one of our offices. Stop payments can also be initiated over the phone. However, a verbal request for a stop payment is only valid for 14 days. You will need to make arrangements to stop in to the bank to sign the stop payment request or have the form mailed to you. The information needed to process a stop payment request includes:

- Name of Payee

- Check Number

- Amount

- Date Written

A stop payment can also be initiated online using iConnect or bizConnect. Please have the above information ready when placing the stop online

You can receive help placing a stop payment by visiting one of our offices. Stop payments can also be initiated over the phone. However, a verbal request for a stop payment is only valid for 14 days. You will need to make arrangements to stop in to the bank to sign the stop payment request or have the form mailed to you. The information needed to process a stop payment request includes:

- Name of Payee

- Check Number

- Amount

- Date Written

A stop payment can also be initiated online using iConnect or bizConnect. Please have the above information ready when placing the stop online

What is the daily limit for a Check Card?

The limits on our check cards are customizable; however the default limits are set at $210 for ATM withdrawals and $500 dollars for POS (point of sale) transactions daily. If you need need an amount that differs from the dollar amounts listed please contact your banker for assistance.

If I have a checking account and a loan can I make an automatic loan payment?

Yes. There are several different options for this. If you have your checking and loan with Peoples Bank, simply contract us to request an automatic transfer form. If your checking account is located elsewhere but your loan is with Peoples Bank, contact your lender to request an automatic transfer request form. If your loan is elsewhere you may be able to establish an automatic payment through our electronic service (ie. billpay or Popmoney).

When using the bill payment option how is the transaction completed?

Our bill pay company, Check Free, decides how the payment will process on a case by case basis.

Can I receive my bank statements electronically?

Yes, by enrolling in eStatements through our online banking service.

How can I sign up for internet banking?

For personal accounts you can visit our homepage and click the iConnect link and follow the step-by-step process. If you would prefer us to assist you with this process, please stop in or call the location nearest you.

For business accounts you can visit our homepage and click the bizConnect link. You will then download and complete the bizConnect application form. Once the form is completed, please fax it to 763.552.1224, or drop it off at the location nearest you. If you would prefer to mail it please send it to the following address: Peoples Bank of Commerce, Attn: bizConnect Enrollment, 234 East First Ave, PO Box 592, Cambridge MN 55008.

What does it take to open a personal checking or savings account?

Depending on the type of account being opened may affect the documents required.

To help the government fight the funding of terrorism and money laundering activities, federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account.

What this means for you: When you open an account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver’s license or other identifying documents.

If you have questions regarding the specifics required for your situation, please call or stop in to one of our six locations and a banker will be happy to assist you.

Why do you need me to verify my contact information when the bank says they will never ask for my personal information?

If questions come up regarding your account we need to be able to reach you. The best way to reach you is typically by telephone or cell phone. If we are unable to reach you right away then we will send you an email or letter.

Home | Privacy Statement | Additional Online Privacy Safeguards | Terms & Conditions

© 2024 Peoples Bank of Commerce, All Rights Reserved.

Marketing and Website provided by SPC

Charter Office

234 East First Ave,

PO Box 592

Cambridge, MN 55008

763.689.1212